If you're looking for the best life insurance rates, you should consider getting coverage through a life insurance company with a good reputation. A good company will have a variety of policies to choose from, and they will be able to provide the best life insurance rates with a quote that reflects your specific needs. You can also contact the company if there are any changes in your life that might impact your coverage.

Image source: Google

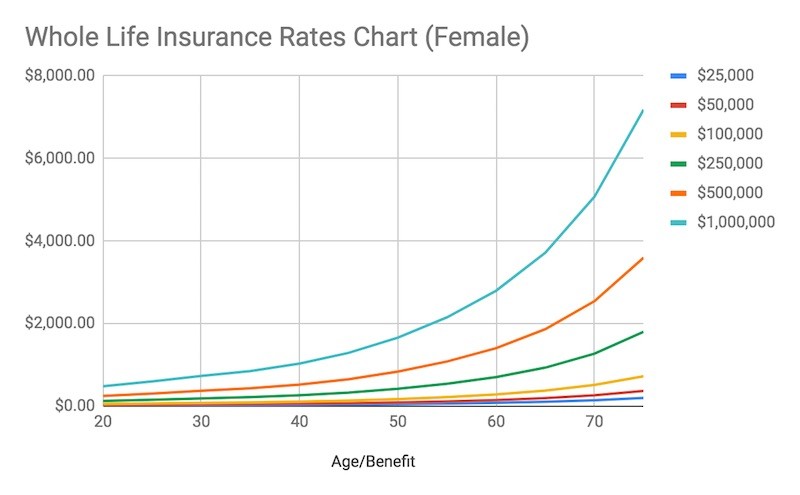

When searching for life insurance rates, it is important to take into account a few key factors. First, it is important to understand how much coverage you need. Second, it is important to understand your risk factor and what kind of coverage is best for you. Third, it is important to compare rates from different companies to find the best policy for you and your family.

When looking to buy life insurance, the first step is to identify your priorities. Do you want term or permanent coverage? How much coverage do you need? Are you looking for a single policy or a combined policy? All of these questions will help you determine which type of life insurance is best for you.

Once you have answered these questions, you can start browsing through life insurance rates online. The best way to find the best rates is to compare quotes from different providers. You can use websites like Insure.com or LifeInsuranceQuotes.net to compare quotes from multiple providers in minutes.

You should also consider factors like age, health history, and family situation when comparing rates. Ultimately, the best way to find the best life insurance rates is to shop around and compare quotes from multiple providers.